Introduction to the Collateral for Storage Mechanism

Conflux Network employs a pricing method called Collateral for Storage (CFS) to calculate storage fees. Compared to Ethereum’s one-time storage fee, the CFS mechanism is more equitable and reasonable. This mechanism involves locking a specific amount of funds as collateral for the storage space occupied by the node.

Each storage entry in the Conflux network occupies 64 bytes (B), and the required deposit to store the entry is proportional to the minimum multiple of 64B that can cover all stored items. For every storage entry with a size of 64B, 1/16 CFX is locked by the owner. Therefore, 1KB of space requires a deposit of 1 CFX.

Is CFX used for storage collateral in circulation?

To properly answer this question, it is crucial to comprehend the four states of CFX in the network and their respective roles.

(1) Circulating CFX: CFX released and circulating in the network can be transferred, sold, and used to pay storage deposits and smart contract interaction fees.

(2) Locked and Pending Unlock CFX: For example, CFX are locked in contracts for four years and can only be unlocked and turned into circulating CFX when certain conditions are met.

(3) Semi-locked CFX: CFX that are locked as collateral in the storage space and become circulating CFX once the corresponding storage entries are destroyed. However, the storage collateral CFX paid by current ecosystem projects on Conflux is mainly sponsored by the Foundation and remains semi-locked even if the storage space is released.

(4) Burned CFX: CFX stored in zero addresses or burned via CIP-107 cannot become circulating CFX.

CFX is considered circulating until the storage deposit is paid. When an account α becomes the owner of a storage entry (created or modified), α should immediately lock in 1/16 CFX. The required deposit is automatically locked if α has a sufficient balance. Otherwise, the operation fails, and the account cannot create or modify the storage entry.

After paying the collateral fee for a storage entry, the corresponding collateral CFX will become non-circulating and cannot be transferred or sold.

However, when a storage entry is deleted from the Conflux, the 1/16 CFX deposit associated with it will be unlocked and returned to the owner’s balance, becoming circulating CFX and again available for transfer or sale.

On-chain Data Analysis

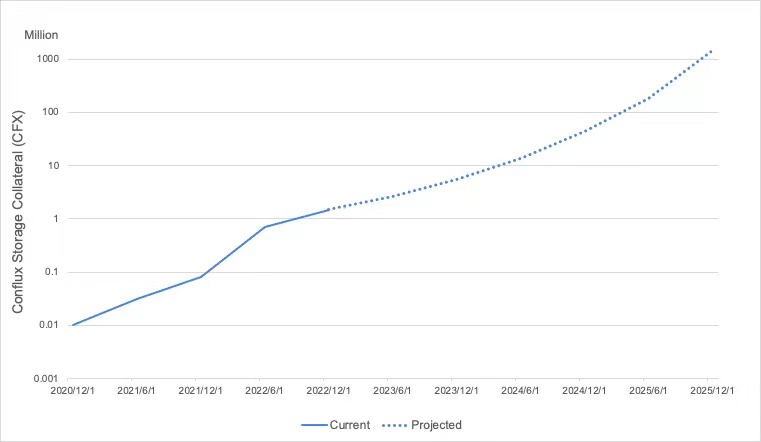

Since the mainnet launch of Conflux in October 2020, the CFS (Collateral for Storage) mechanism has gained traction among developers, with over 3.22 million CFX of storage collateral locked in a semi-locked state. This collateral can only be re-circulated once the storage entry is destroyed.

It is worth noting that as Conflux grows, more NFT applications are deployed on the platform. In 2022, over 1.5 million CFX of storage collateral was added to the network.

Practical Significance of CIP-107

CIP-107 proposes a mechanism to address the inflation of CFX and improve Conflux’s token economy. The proposal introduces different scenarios to destroy a portion of stored collateral when a state is released in a transaction. For instance, assuming m CFX is the amount of stored collateral related to specific states and p is the percentage of collateral to be destroyed. After the state is released, only m*(1-p) CFX will be refunded, while the rest will be destroyed. The value of p can be set to 0, 0.25, 0.5, 0.75, or 1.

Consider the following examples of CFX burning:

Example 1: When p is 1, the previously mentioned 3.22 million CFX will be destroyed and no longer circulate.

Example 2: When p is 0.75, 1.87 million CFX of the 3.22 million CFX will be destroyed and no longer in circulation, while 0.8 million CFX will be refunded into circulation.

Example 3: When p is 0.5, 1.61 million CFX of the 3.22 million CFX will be destroyed and no longer in circulation, while 1.61 million CFX will be refunded into circulation.

Example 4: When p is 0.25, 0.8 million CFX of the 3.22 million CFX will be destroyed and no longer in circulation, while 1.87 million CFX will be refunded into circulation.

Example 5: When p is 0, all 3.22 million CFX will be refunded into circulation.

Implementing CIP-107 on Conflux Network will introduce a deflationary mechanism and increase the value of the CFX token. As more collateral deposits are locked and released in the future, the economic model of Conflux Network will be more refined and healthy.

Relationship between the growth of the on-chain NFT quantity and the reduction of circulating tokens

As of March 1, 2023, over 7.18 million NFTs were issued on Conflux Network, with each NFT requiring payment of collateral storage fees using CFX as per the Collateral for Storage mechanism. These collateral CFX will be in a semi-locked state, with the Foundation offering some collateral storage sponsorships to ecosystem applications, effectively reducing the number of circulating tokens.

With the number of NFTs increasing, CFX in a semi-locked state will continue to grow. Therefore, if the CIP-107 destruction proposal is adopted, a portion of the collateral deposit can be destroyed in accordance with the proposal when using or invoking the NFT contracts, reducing the number of CFX tokens in circulation and further enhancing the token deflation.