1 Funding Tier:

Tier 3 requested amount - 100K

2 Project Overview: Please include the following:

2-1 Project title and description of the project.

ACY Finance is an anti-robot DEX. ACY invents Flash Arbitrage, a protocol level implementation that executes to reduce the arbitrage activities of miners and other kinds of arbitrage robots in each transaction.

Flash Arbitrage:

We have created a entirely new track in Defi sector, which is Flash Arbitrage DEX, where our transactions are capable of fight back the Miners from doing arbitrage on our users.

Flash Arbitrage, is our greatest innovation to fight against the MEV problem. It is an arbitrage strategy integrated into the protocol, aka written in the smart contract. It is executed automatically each time when the user initiates swap transactions. Similar to flash loans, flash arbitrage happens in an instant. But instead of one block, flash arbitrage happens in one single transaction along with your swap. Therefore there will be no more arbitrage opportunities after our swap transactions as our protocol has already harvested the arbitrage benefits.

Flash Arbitrage is a creation invented to help promote a fair competition for users by ACY Finance. Which is why we wanted our solution to be Anti-MEV but also Anti-corruption to fight against the robots. In this new world created by ACY, the interest of both Traders and Liquidity Providers will be appreciated.

For more info about Flash Arbitrage, please check out**:** https://acy-finance.gitbook.io/acy-finance/product/acy-swap/flash-arbitrage

ACY DAO

ACYDAO is a Governance Portal for users to stake their ACY tokens, participate in governance and take rewards of their contributions. The reward is harvest from a portion of Flash Arbitrage Revenue.

20% of the Flash Arbitrage revenue will go to DAO participants once ACY DAO is launched.

2-2 How will this project be integrated into Conflux?

- First step is to start from deploying our smart contracts on Conflux Blockchain, we had our product ready for Polygon as we attended their hackathon with this project. Now we just need to modify the contracts to make it fit to the Conflux blockchain.

- Secondly, we will be implementing whitelist contracts for our dapp as this is a unique feature on conflux that is super welcomed by both projects and users.

- We will expand our application to solana and establish our bridge between the two chains.

- It is expected for us to launch our project on multiple chains, prioritizing Conflux, Solana, Polygon, and Ethereum.

- With all the bridges ready for application, it is likely to attract liquidities from different blockchains to Conflux with for users to invest in Conflux native assets.

2-3 Why is your team interested in creating this project?

We are a team who has plenty full of experience in Stock trading and financial investments. We saw the opportunity of anti-MEV as since early this year. There are several attempts have done to fix the MEV problem from the blockchain level. But with Miners extracting so much value out from this behavior, there is huge resistant in stopping MEV from happening. Therefore as it is important for DEX platforms to make their exchange competable to Miners, that’s where Flash Arbitrage comes into play. Flash Arbitrage is a birth child of our indepth observation, understandings of blockchain, and heavy Brainstorming. We believe that by helping user secure their Alpha from the arbitragers, not only users will earn more from our platform but also becoming longterm supporters. This Flash Arbitrage DEX is one of a kind that no other has done before, and we believe that our solution will not only just solve the MEV problem but all Arbitrage problems.

3 Project Details: Please include the following:

3-1 High-level technical approach, product flow & architecture (along with a diagram).

What is Flash Arbitrage?

Flash Arbitrage is a protocol level integrated arbitrage strategy to help us fight against Miners. Our smart contract will split user’s swap transaction into multi-route arbitrage transaction inside the same swap transaction. Users can then automatically profit from the arbitrages, enjoy the lower price slippage and more stable price. Without big enough arbitrage opportunities, arbitragers including the miners’ bots will be disinterested in swap transactions from our platform.

What’s more, Flash Arbitrage is executed using a mathematical model to calculate the most optimal routes during runtime, aka during transaction execution. Unlike 1inch and other platforms where they calculate the routing solutions before they do the swap transaction, ACY Finance has no delay and is more accurate for its protocol level implementation of the algorithm.

Instead of the direct exchange for the target token by users, the ACY contract is automatically split into multiple paths to exchange the target token. The liquidity equivalent to this exchange is the sum of the liquidity of all relevant paths, which can help users obtain arbitrage gains and greatly reduce the trading slippage.

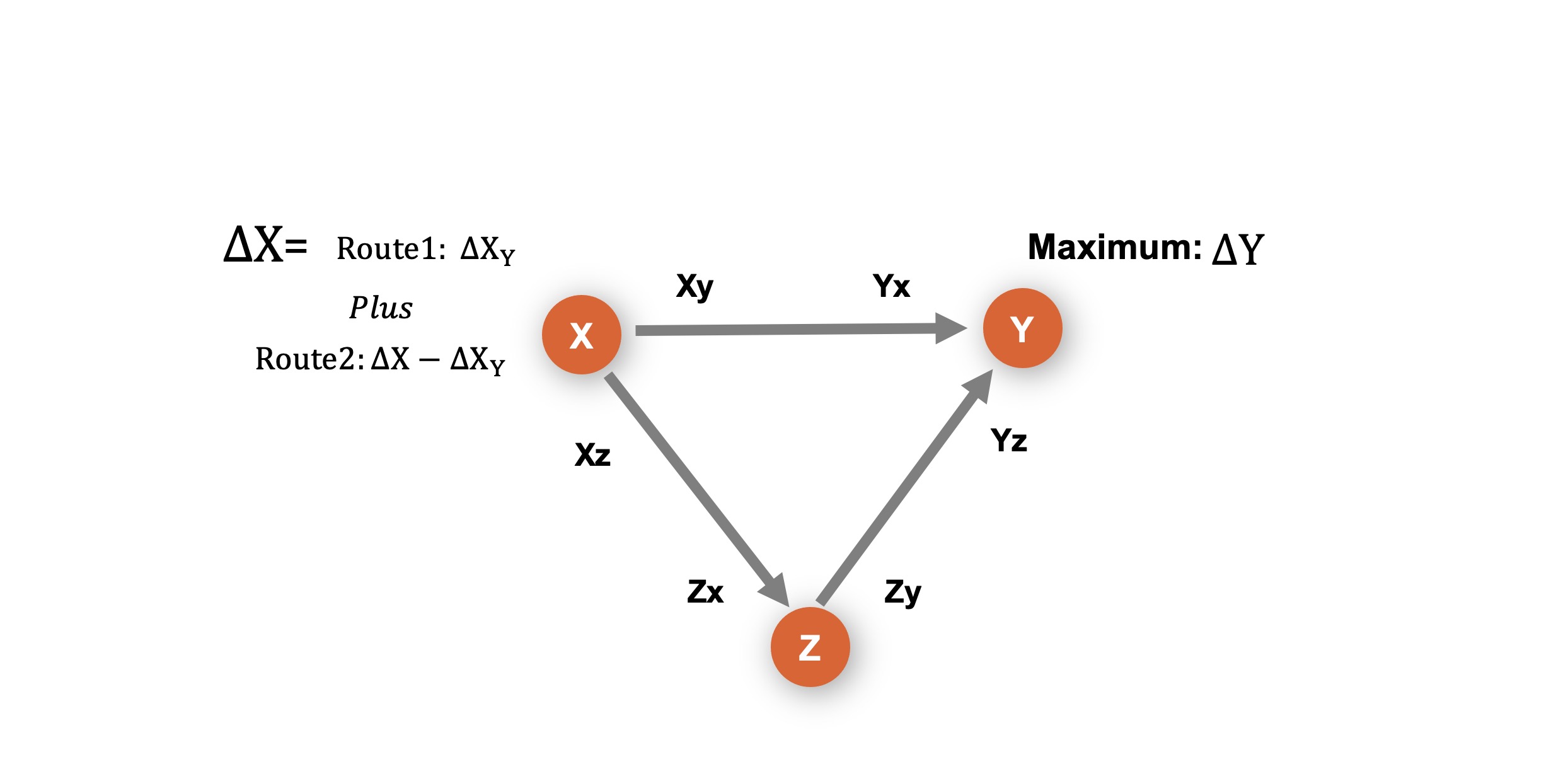

A visual explanation can be seen in the following Figure where when an user wants to swap from X token to Y token, our methematical model will calculate how much X will go through X->Y, and how much X will go through X->Z->Y to conclude the transaction.

The extra income that is earned from Flash Arbitrage will be distributed to All users and ecosystem, More details here.

Regarding of Methematical Details of Flash Arbitrage, Please check out our whitepaper.

3-2 Any mockup designs of user facing components.

Here is link of our testnet to checkout more: test.acy.finance

Swap Page Upper Portion

Swap Page Lower Portion

Market Info Page

Farms Page

ACY DAO Page

3-3 Overview of the technology stack being used, including API specifications, and documentation of core components.

Technology Stack

- ReactJS for frontend

- Conflux SDK for connecting frontend to blockchain services

- Solidity for AMM with Flash Arbitrage Algorithm, Liquidity, Farming, DAO smart contracts

- ExpressJS for market data

Here is our github repo for more infomation: https://github.com/ACY-Labs

3-4 Ecosystem fit: How can the project benefit Conflux Network’s ecosystem?

ACY Finance is designated to create the lowest price slippage dex for users. We believe that with Conflux’s low transaction fee and fast network speed, the user experience on ACY Finance will be top of its class.

Therefore the benefits for Conflux ecosystems are:

- One excellent AMM-based Flash Arbitrage capable DEX on Conflux, more DEX choices for Conflux users

- Increasing the TVL on Conflux Network, especially after once we launch our dapp on other blockchains such as Ethereum, Solana, Polygon. With Conflux’s advantage of whitelist contracts, we will likely to draw more traffics to Conflux blockchain.

- Available for users to upload any tokens they want on to our DEX.

4 Team: Please include the following:

ACY Finance consists of a group of talented youth from Tsinghua University and Stanford University. Our team is filled with young professionals who come from quantitative finance and stock market backgrounds, and who have much to offer with their rich entrepreneurial experience, blockchain industry experience, and hard-core technical abilities.

Provide the name and registered address of the legal entity that will be delivering the project.

Name: ACY FOUNDATION LTD.

Address: 3 Fraser Street #05-25 Duo Tower, Singapore 189352

5 Development Roadmap:

5-1 Total Grant Budget

5-2 Milestones

Milestone 1 - Mainnet Launch!

Timeline: 2021-Sep to 2021-November

Description: This is a period where we do our testnet testing with our users to get ready for our mainnet launch. The auditing will take some time so as soon as our auditing is finished, then we will launch our mainnet.

Deliverables: Fully Operable DEX with Flash Arbitrage capability. Functionalities will include swap, liquidity mining, and farming.

Milestone 2 - ACY DAO Launch with Pro version access!

Timeline: 2021-November to 2021-December

Description: ACYDAO will be launched for users to participate in our stakable DAO! By staking in our DAO and participate in the governance, users will be able to receive a portion of the Flash Arbitrage revenue as a reward. Pro version access means if users have staked enough token, then they will be eligible to use our pro version DEX where the algorithm of Flash Arbitrage is even more optimized than the previous one.

Deliverables: A DAO interface for users to stake, govern and claim rewards. Pro version portal for those who have staked enough ACY tokens.

Milestone 3 - IDO Platform ACYDO Launch!

Timeline: 2021-December to 2022-Februry

Description: ACYDO will be available for all new conflux ecosystem tokens to launch their IDO on our platform. It is designated to help all projects on conflux to be tradable in Conflux ecosystem.

Deliverables: A complete pipeline for projects to list and launch IDO of their tokens automatically, the listing process will be monitored by ACY DAO entirely, instead of ACY Finance.

Milestone 4 - API/SDK features for Conflux ecosystems

Timeline: 2022-January to 2022-March

Description: Defi services available for other users/projects to utilize on their applications or platforms.

Deliverables: Depending on the design, we will deliver APIs first for other projects to implement our data or services onto their platform. If SDK is heavily requested from our community, then we will move forward with it as well.

6 Long Term Vision

What is the team’s long term vision for the project?

At ACY Finance, we are committed to help users get their best offers for financial services by securing users’ alpha. To achieve this, we have invented Flash Arbitrage where it helps users secure alpha in each and every swap. We are not stopping here, we are reinventing the entire DEX ecosystem where we want to help users earn by not just using our product but also governing our product, market our product, build on top of our product. Not only that, with multi-chain capability available soon, we want to bridge different users from different blockchains to trade with each other, to help users with the best swap conversion rate availalbe.

7 Other:

Please include any further information or attachments that are relevant to your application.

- Official Website: https://acy.finance/

- Testnet: https://test.acy.finance/

- Forum: https://forum.acy.finance/

- Documentation: https://acy-finance.gitbook.io/

- Whitepaper: https://api.acy.finance/ACY Finance Whitepaper.pdf

Social Channels:

- Twitter: https://twitter.com/ACYFinance

- Telegram: t.me/acyfinance

- Linkedin: https://www.linkedin.com/company/acy-finance

- Medium: https://medium.com/acy-finance

Few questions on my end…

Few questions on my end…